by Barbara Head

November elections are over with, but activism can take a different form in December — political donations. There are two reasons for making this your key month for political giving.

1. Giving early in the election cycle does far more good.

Candidates running in 2022 are gearing up their campaigns. They need to raise money now to hire staff, build their infrastructure, plan budgets, and implement research programs. For the candidate, this “early money” is four times as valuable as money that rolls in closer to the election. Most donors wait until the final days of a campaign, when it’s almost impossible to spend that money effectively.

Don’t have the time or resources to decide which campaigns you want to prioritize? Fortunately, some trustworthy organizations have done the research for you.

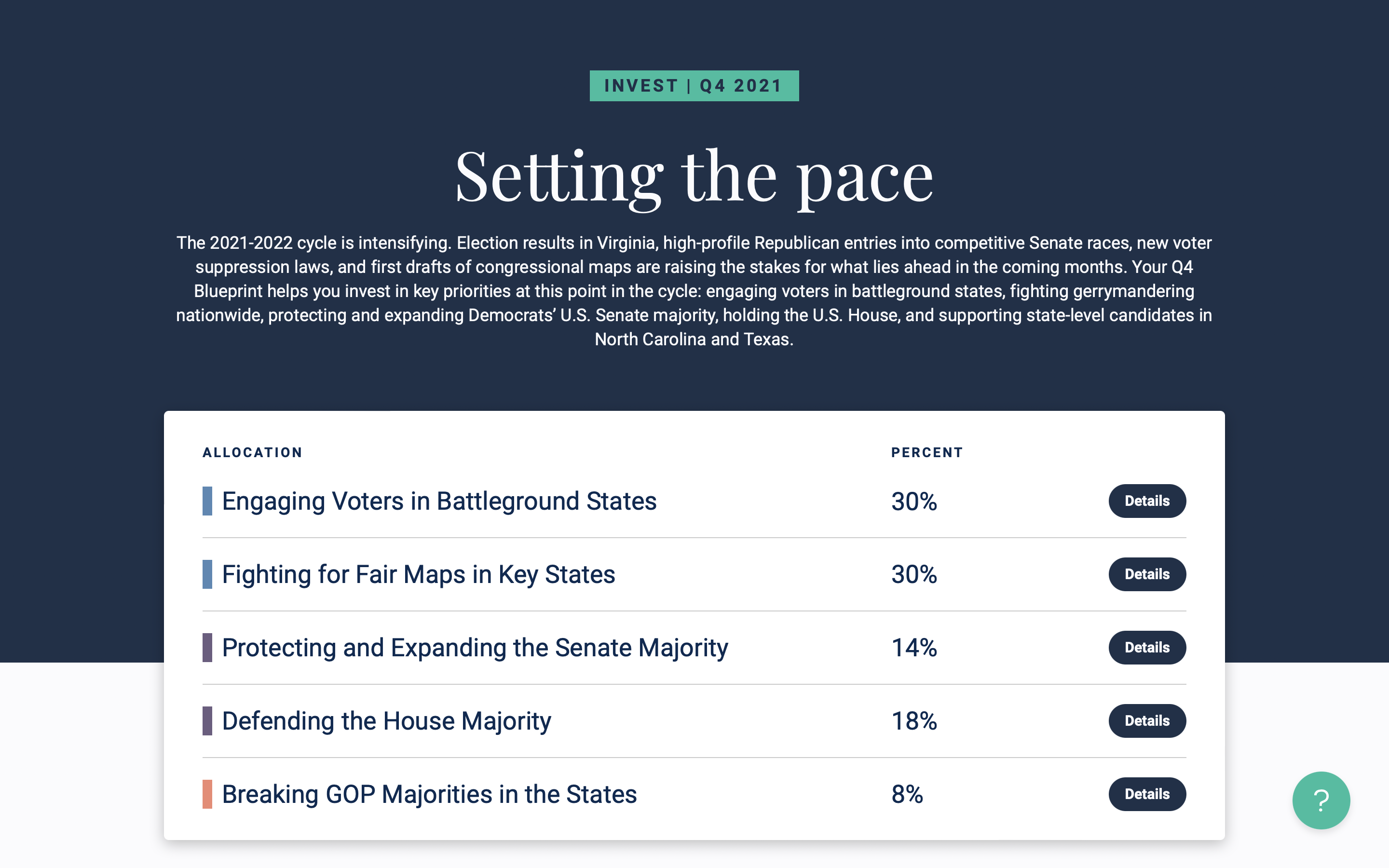

- One of the most convenient options is Swing Left’s Blueprint, which aims to maximize return on investment. A single donation to this fund endows a personalized portfolio that can include contributions to congressional and gubernatorial campaigns as well as on-the-ground organizations that help support them. You just indicate your priorities, and Blueprint creates your investment portfolio.

- Force Multiplier, an independent, all-volunteer fundraising organization based in Boston, also offers targeted funds that ensure that your donations to campaigns are both strategic and impactful. Donations through Force Multiplier provide early money to selected political campaigns through the organization’s US Senate Early Impact and US House Early Impact slates.

- Crooked Media, producers of excellent podcasts like Pod Save America, has a No Off Years Fund to provide early support in six key states.

2. Your donations can work for you as year-end tax-deductible contributions.

While political giving to candidates does not qualify, other forms of financial activism may be tax-deductible, stretching your dollars further. There are many organizations to which you can make tax-deductible gifts because they involve only nonpartisan public-service activities such as education or voter empowerment. For example,

- Force Multiplier’s tax-deductible Democracy in Action Slate educates, registers, and turns out voters in five key states.

- Similarly, their Heartland Fund registers and mobilizes rural voters and fights for fair elections in Senate battleground states.

- Another impactful organization, State Voices, uses data, civic participation, and grassroots organizing to support a network of coalitions that build political power for various racial minorities.

In general, groups organized as 501(c)(3) charities are tax-deductible, while 501(c)(4) charities are not; so check the webpages of orgs that interest you for these designations. Contributions to political action committees (PACS), or any groups that seek to influence legislation, are not tax-deductible.

Take a moment to consider where your political donations can count the most — and give now.

Hunker down for the holidays. We hope they’re joyful for you.

Then spend next year writing postcards and letters, calling and texting voters, canvassing, and taking other actions to protect our democracy.

Leave a Reply